Democratizing Access to Capital Markets

In a historic move, Dream Exchange is set to become the first majority black-owned stock exchange in America, marking a significant step towards democratizing access to capital markets.

Founded by Joe Cecala and Dwain J. Kyles, Dream Exchange aims to bridge the gulf between Main Street and Wall Street, providing a platform for small and medium-sized businesses, particularly those from underrepresented communities, to access public capital markets.

“We help to form capital, we help people reach the public markets,” Cecala said. “We also regulate how the buying and the selling of stocks is done every day.”

Overcoming Historical Barriers to Wealth Building

The launch of Dream Exchange comes at a pivotal time when marginalized communities, including Black and Hispanic households, have faced significant barriers to building generational wealth.

Discriminatory practices, such as redlining and restricted access to mortgages and affordable housing, have historically made it harder for these communities to accumulate wealth and invest in the stock market.

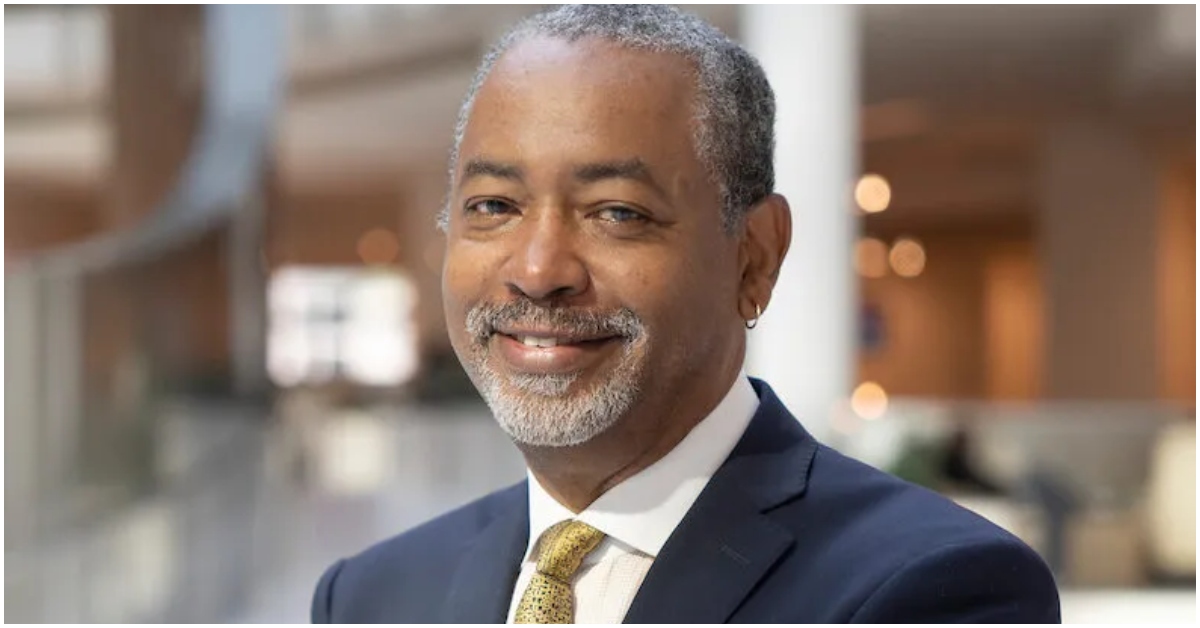

“We didn’t have a grandfather or aunt or uncle or mom and dad educating us on the markets because they didn’t benefit from it because of historical discrimination in this country,” said John Rogers, founder and co-CEO of Ariel Investments.

A Seat at the Table for Minority Investors

Dream Exchange is poised to shatter these barriers, with a base comprising approximately 75-80% accredited Black investors and a growing board of Black business leaders. Cecala emphasizes the exchange’s commitment to diversity, stating, “We’re truly a diversely staffed company. It’s a seat at the table.”

However, the exchange’s services are open to anyone, regardless of race, with a mission to foster prosperity across all communities in the nation.

Fueling Innovation and Job Creation

By providing a platform for early-stage and emerging enterprises to leverage public capital markets, Dream Exchange aims to stimulate innovation, create jobs, and build wealth in underserved communities.

Cecala underscores the ripple effect this could have on solving societal problems, saying,

“If we can build these companies and expand them, we’ll have prosperous communities.”

“Most people in all communities have access to Main Street in some form or another, but the gulf which exists between Main Street and Wall Street has continued to exist, and we see that serving as that bridge as being vital to the revitalization of our economy,” said Dwain J. Kyles.

With the launch of Dream Exchange, a new era of economic empowerment and inclusion is on the horizon, promising to unlock untapped potential and create a more equitable financial landscape for all.